Health coverage comparison answer key ramsey – The health coverage comparison answer key for Ramsey empowers individuals with the knowledge to make informed decisions about their health insurance plans. This comprehensive guide unravels the intricacies of HMOs, PPOs, EPOs, and more, providing a clear understanding of coverage details, costs, provider networks, and additional benefits.

Dive into this exploration and discover the key to unlocking optimal health protection in Ramsey.

1. Insurance Policy Options: Health Coverage Comparison Answer Key Ramsey

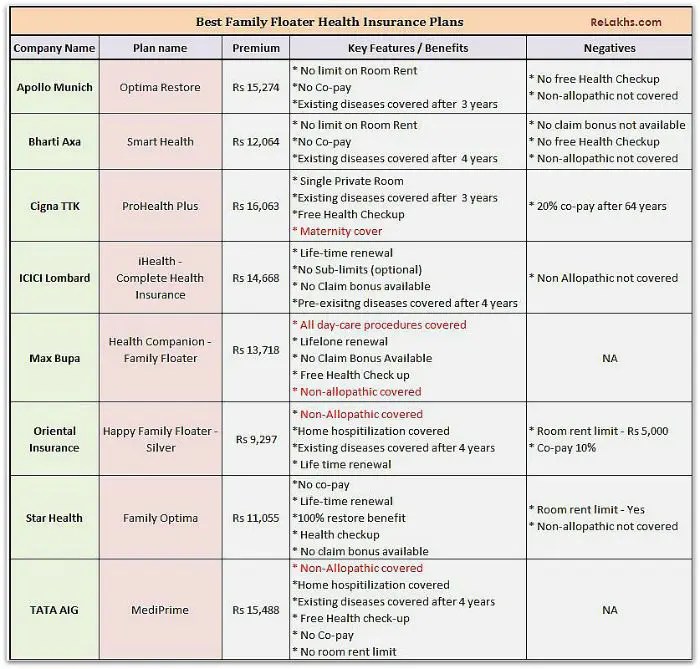

In Ramsey, individuals have access to various types of health coverage plans, each with its own advantages and disadvantages. These plans include Health Maintenance Organizations (HMOs), Preferred Provider Organizations (PPOs), and Exclusive Provider Organizations (EPOs).

HMOs offer a network of healthcare providers and facilities that members must use for covered services. HMOs typically have lower premiums but may have more restrictions on provider choice. PPOs provide more flexibility in choosing providers, both within and outside of the network, but may have higher premiums.

EPOs are similar to HMOs but have even more restrictions on provider choice, resulting in lower premiums.

Popular health insurance providers in Ramsey include Blue Cross Blue Shield of Minnesota, Medica, and HealthPartners. Each provider offers a range of plans with varying benefits and costs.

2. Coverage Details

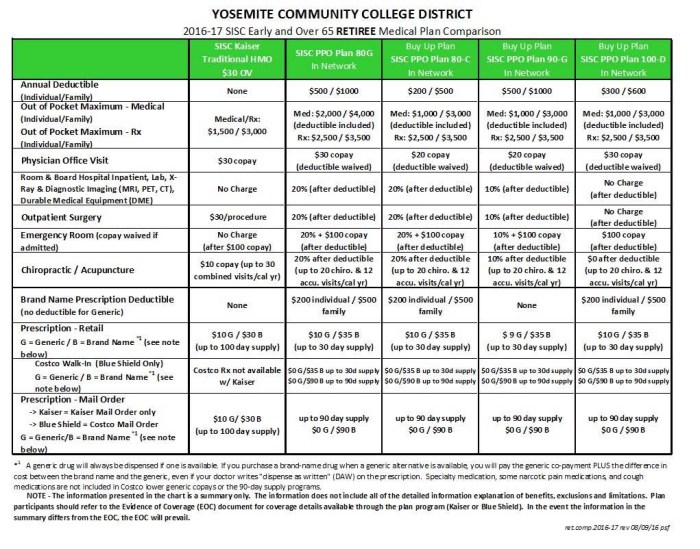

Health insurance plans in Ramsey provide coverage for a wide range of services, including doctor visits, hospital stays, and prescription drugs. However, there may be variations in coverage depending on the plan type and provider.

Most plans cover preventive care services, such as annual physicals and screenings, with no out-of-pocket costs. However, there may be deductibles or copayments for other services, such as doctor visits or hospitalizations. Some plans may also have exclusions or limitations for certain services, such as mental health or dental care.

It is important to carefully review the coverage details of each plan before enrolling to ensure that it meets your specific healthcare needs.

3. Costs and Premiums

The cost of health insurance in Ramsey varies depending on factors such as age, health status, and plan type. Monthly premiums can range from a few hundred dollars to over a thousand dollars.

Deductibles are also an important factor to consider. A deductible is the amount you must pay out-of-pocket before your insurance coverage begins. Higher deductibles typically result in lower premiums, while lower deductibles lead to higher premiums.

Subsidies and tax credits may be available to help reduce the cost of health insurance for low-income individuals and families.

4. Provider Networks

Health insurance plans in Ramsey have different provider networks, which are the hospitals, clinics, and doctors that are covered under the plan.

When choosing a plan, it is important to consider the provider network to ensure that your preferred healthcare providers are included. Some plans may have a narrow network, while others may have a broader network that includes more providers.

If you have a specific doctor or hospital that you prefer, it is essential to verify that they are in the network of the plan you are considering.

5. Customer Service and Support

Customer service and support are important aspects to consider when choosing a health insurance provider. Individuals should look for providers that offer convenient and responsive customer service channels.

Some providers may offer 24/7 support, while others may have limited hours. It is also important to consider the availability of online support and self-service options.

Reviews or testimonials from customers can provide valuable insights into the quality of customer service offered by different providers.

6. Additional Features and Benefits

In addition to the core coverage, some health insurance plans in Ramsey offer additional features and benefits to enhance the overall health and well-being of their members.

These features may include wellness programs, discounts on health-related products, or access to telemedicine services. Wellness programs can help individuals track their health, set goals, and earn rewards for healthy behaviors.

Discounts on health-related products, such as gym memberships or fitness trackers, can encourage members to adopt a healthier lifestyle. Telemedicine services allow members to consult with healthcare providers remotely, providing convenient access to care.

FAQ Section

What is the difference between an HMO and a PPO?

HMOs (Health Maintenance Organizations) require members to choose a primary care physician who coordinates their care and refers them to specialists within the plan’s network. PPOs (Preferred Provider Organizations) offer more flexibility, allowing members to see specialists without a referral and access a broader network of providers.

How do I find affordable health insurance in Ramsey?

Explore options through the Health Insurance Marketplace, compare plans from multiple providers, and consider subsidies and tax credits that may reduce the cost of coverage.

What is the best health insurance plan for me?

The ideal plan depends on your individual needs, health status, and budget. Consider factors such as coverage details, provider network, and out-of-pocket costs to determine the best fit.